By: Kathryn Boonstra

The teacher labor market may be more front-of-mind for everyday Americans today, in the aftermath of COVID-19, than any other time in recent history. While initial fears of a mass exodus of teachers may not have borne out as predicted, schools across the country are still reeling from the pandemic’s effects, and in many areas, there are not enough teachers as there are classrooms full of children. But the underlying conditions responsible for chronically high teacher turnover and educator shortages pre-dated the pandemic: overwhelming workloads, unsupportive and increasingly unmanageable working conditions, and compensation that lags far behind similarly educated workers in other fields.

In August 2020, in the middle of COVID-19 school closures, then-Dean Diana Hess of the University of Wisconsin-Madison’s School of Education introduced a novel initiative to move the needle on teacher workforce problems in the state of Wisconsin. The Wisconsin Teacher Pledge uses one of the most powerful policy levers available to a state university—financial aid—to help recruit and retain teachers in the state of Wisconsin.

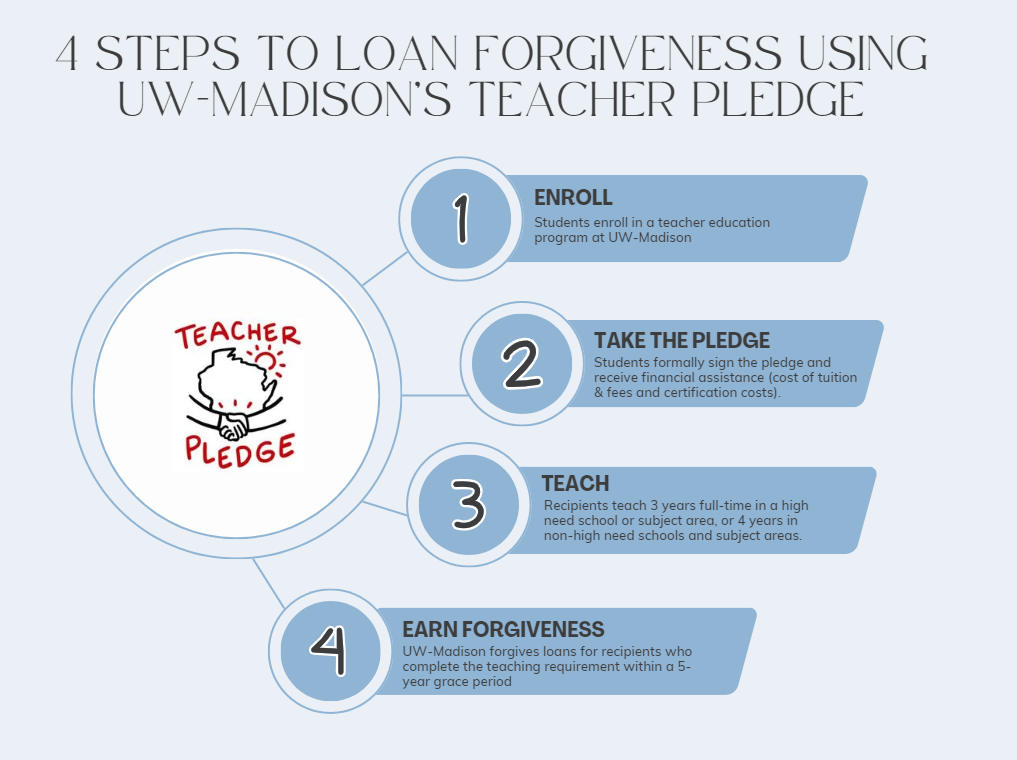

The Teacher Pledge offers eligible students—those actively enrolled in a teacher education program at UW-Madison—forgivable loans up to the cost of in-state tuition and fees for the duration of their teacher education program, plus a one-time stipend to cover licensure costs. Upon graduating and earning endorsement for licensure, Teacher Pledge recipients enter a five-year grace period during which they can “teach off” their Teacher Pledge loans through three years of full-time teaching in a high need school or subject area, or four years for non-high need schools and subject areas. Any remaining balance at the end of the grace period must be repaid.

Teacher Pledge loans are institutional loans, meaning they are disbursed—and later forgiven—directly by UW-Madison, not the federal or state government or a private financial institution. There are no complicated eligibility criteria, and students can receive Teacher Pledge loans even if they have no demonstrated financial need. There is no application form, apart from the Free Application for Federal Student Aid, or FAFSA, which participants must complete every year, and any school or childcare center in the state can qualify for forgiveness. Participants have five years to complete the required service commitment, and a portion of the loans is cancelled after each qualifying year of service.

How much will a service-contingent loan program like the Teacher Pledge contribute to growing and diversifying the next generation of teachers? Will it influence new teachers’ decisions about whether and where they teach? Can the Teacher Pledge be a model for teacher recruitment and retention initiatives across the state, or even the nation?

These are among the questions the SSTAR Lab aims to answer through our multi-year, mixed method study of the Teacher Pledge.

As the School of Education’s research and evaluation partner for the Teacher Pledge, our work began around the time the program launched in 2020. The first phase focused on formative evaluation and program improvement. Now, four years into the Teacher Pledge study, we are transitioning to summative analysis of the program’s effectiveness and impact. Our study uses administrative data from UW-Madison and Wisconsin’s Department of Public Instruction, surveys with teacher education students and alumni, artifacts from the School of Education and Wisconsin Teacher Pledge, and interviews with students, staff, and alumni. To date, we have records for over 2,500 UW-Madison teacher education students, including 854 Teacher Pledge participants. We have collected over 1,300 survey responses, covering topics ranging from career intentions and workforce experiences to college financing and financial wellness.

There will be much more to share in coming months and years, but for now we hope this post offers enough background on the Teacher Pledge so you may follow our forthcoming work. Later posts will describe our approach to a research-practice partnership in the context of this project, discuss the role of administrative burdens in service-contingent loan programs, and preview other preliminary findings from this study. Stay tuned, and sign up here to receive email updates with other new work from SSTAR Lab.